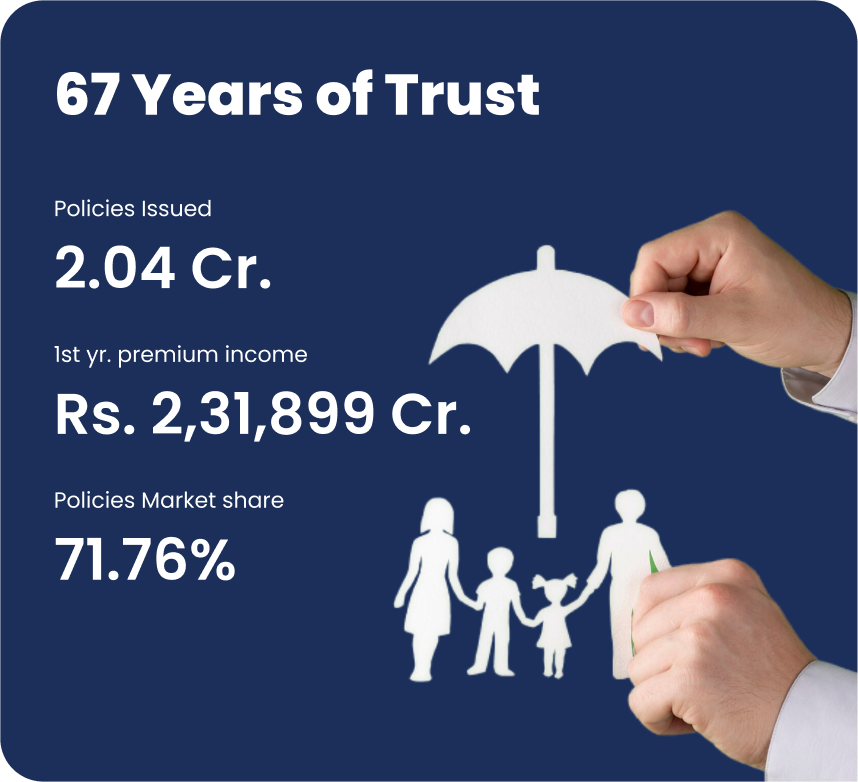

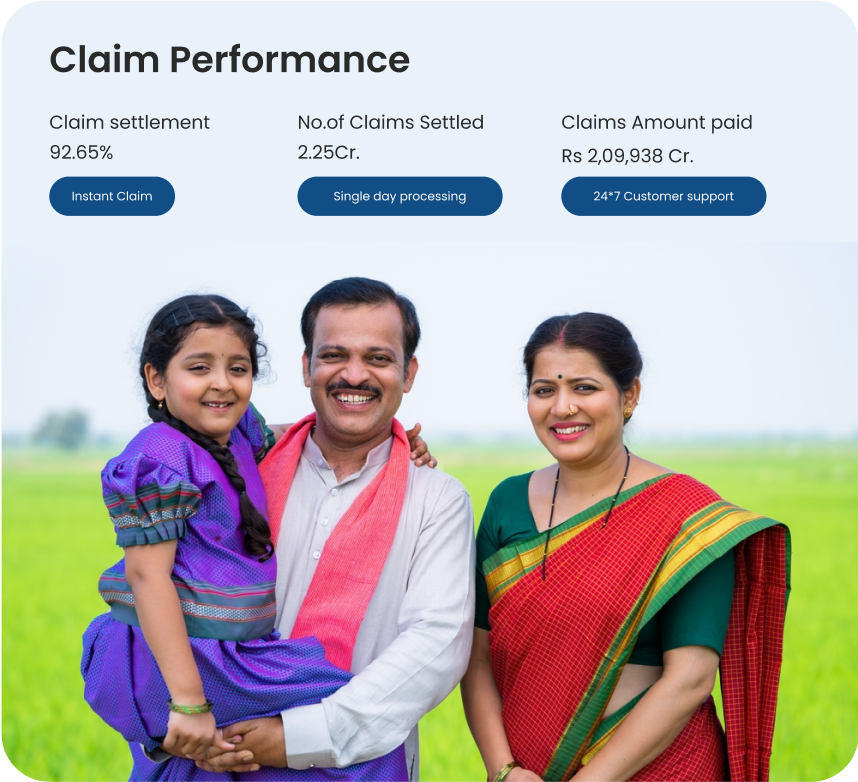

Why LIC?

LIC offers unmatched reliability and trust, with a legacy of securing millions of lives over decades

Having Trouble with LIC Policy Services?

बीमा पॉलिसी से संबंधित किसी भी समस्या के लिए संपर्क करें।

बीमा पॉलिसी से संबंधित किसी भी समस्या के लिए संपर्क करें।

Contact us directly for hassle-free support and prompt assistance.

D.O.B Correction

D.O.B Correction

We assist in accurate date of birth

correction to ensure your policy details

are up-to-date and error-free.

Death Claim

Death Claim

We provide prompt and compassionate

support for filing death claims, ensuring a smooth and hassle-free process for your

loved ones.

Nominee Change

Nominee Change

Our team helps you easily update or change your nominee details, keeping your policy aligned with your current wishes.

Money Back

Money Back

Receive regular payouts at specified intervals, providing you with liquidity and financial stability throughout the policy term.

Maturity

Maturity

Enjoy a lump sum payment at the end of the policy term, ensuring you achieve your financial goals and dreams.

NEFT

NEFT

Benefit from seamless and quick fund transfers directly to your bank account through our secure NEFT system.

Revival

Revival

Reinstating a lapsed policy can be complex. We offer comprehensive support to help you revive your policy and regain your coverage.

Policy Loan

Policy Loan

Access the funds you need by availing of a policy loan. We simplify the process, ensuring you get the financial support promptly and efficiently.

Policy Surrender

Policy Surrender

If you need to surrender your policy, we provide clear guidance and assistance to help you navigate the process smoothly, ensuring you receive the benefits you are entitled to.

Agent Details

Agent Code: 1374511J

Name: Vineeta Mittal

D.O Code: M007511J

Branch: 11J

Experience: 2+ Years

Agent Code: 1374511J

Name: Vineeta Mittal

D.O Code: M007511J

Branch: 11J

Experience: 2+ Years

Buy LIC plans tailored for you!

Jeevan Labh

LIC’s Jeevan Labh is a non-linked, with-profits endowment plan that combines savings with protection. It is designed to provide financial support to your family in case of your unfortunate demise and also offers a lump sum amount at the end of the policy term for your financial goals.

1) Offers a combination of savings and protection, with maturity and death benefits.

2) Provides financial support through loan facilities against the policy.

Jeevan Labh

LIC’s Jeevan Labh is a non-linked, with-profits endowment plan that combines savings with protection. It is designed to provide financial support to your family in case of your unfortunate demise and also offers a lump sum amount at the end of the policy term for your financial goals.

1) Offers a combination of savings and protection, with maturity and death benefits.

2) Provides financial support through loan facilities against the policy.

Jeevan Umang

LIC’s Jeevan Umang is a whole life insurance plan that provides coverage up to the age of 100, along with annual survival benefits from the end of the premium-paying term until maturity. It ensures a lifetime of financial security for you and your family.

1) Provides annual survival benefits and a lump sum maturity benefit.

2) Ensures lifetime coverage with the flexibility of premium payment terms.

Jeevan Umang

LIC’s Jeevan Umang is a whole life insurance plan that provides coverage up to the age of 100, along with annual survival benefits from the end of the premium-paying term until maturity. It ensures a lifetime of financial security for you and your family.

1) Provides annual survival benefits and a lump sum maturity benefit.

2) Ensures lifetime coverage with the flexibility of premium payment terms.

Jeevan Lakshya

LIC’s Jeevan Lakshya is an endowment plan offering a combination of protection and savings. It provides financial security to your family in case of your absence and ensures a lump sum amount at maturity to fulfill your financial goals and aspirations.

1) Offers annual income benefit for the family in case of policyholder’s demise.

2) Provides a lump sum maturity benefit to meet long-term financial goals.

Jeevan Lakshya

LIC’s Jeevan Lakshya is an endowment plan offering a combination of protection and savings. It provides financial security to your family in case of your absence and ensures a lump sum amount at maturity to fulfill your financial goals and aspirations.

1) Offers annual income benefit for the family in case of policyholder’s demise.

2) Provides a lump sum maturity benefit to meet long-term financial goals.

Money Back

LIC’s Money Back policies are designed to provide periodic payments of survival benefits during the term of the policy. This ensures that you receive regular financial support while still enjoying insurance coverage, making it an ideal plan for those needing liquidity.

1) Provides regular survival benefits every few years during the policy term.

2) Offers maturity benefits along with death benefits and additional bonuses.

Money Back

LIC’s Money Back policies are designed to provide periodic payments of survival benefits during the term of the policy. This ensures that you receive regular financial support while still enjoying insurance coverage, making it an ideal plan for those needing liquidity.

1) Provides regular survival benefits every few years during the policy term.

2) Offers maturity benefits along with death benefits and additional bonuses.

ULIP Plans

Unlock the power of investment with our ULIP Plan, a unique blend of insurance and investment that offers you the flexibility to choose how your premiums are invested. Here’s what sets our ULIP Plan apart:

1) Choose How Your Money Grows: With our ULIP, you decide where your money goes—whether into stocks, bonds, or a mix that suits you.

2) Life Cover Included: It’s not just about investing; your loved ones are financially protected if something unexpected happens.

ULIP Plans

Unlock the power of investment with our ULIP Plan, a unique blend of insurance and investment that offers you the flexibility to choose how your premiums are invested. Here’s what sets our ULIP Plan apart:

1) Choose How Your Money Grows: With our ULIP, you decide where your money goes—whether into stocks, bonds, or a mix that suits you.

2) Life Cover Included: It’s not just about investing; your loved ones are financially protected if something unexpected happens.

Pension Plan

Secure your golden years with our Pension Plan, designed to provide a steady income stream after retirement. Here are the benefits of opting for our Pension Plan:

1) Regular Income Post-Retirement: Enjoy a regular stream of income to maintain your lifestyle and meet daily expenses even after you retire.

2) Tax Benefits: Avail tax benefits under prevailing tax laws, making it an efficient way to plan for retirement while saving on taxes.

Pension Plan

Secure your golden years with our Pension Plan, designed to provide a steady income stream after retirement. Here are the benefits of opting for our Pension Plan:

1) Regular Income Post-Retirement: Enjoy a regular stream of income to maintain your lifestyle and meet daily expenses even after you retire.

2) Tax Benefits: Avail tax benefits under prevailing tax laws, making it an efficient way to plan for retirement while saving on taxes.

How to Get Started?

Getting started with LIC is simple and straightforward. Follow these easy steps to secure your future:

- Consultation: Schedule a free consultation with our expert advisors to discuss your financial goals and insurance needs.

- Plan Selection: Choose the LIC plan that best suits your requirements from our wide range of options.

- Documentation: Complete the necessary paperwork with our guidance, ensuring all details are accurate and up-to-date.

- Approval and Payment: Submit your application for approval. Once approved, make the initial premium payment to activate your policy.

- Policy Issuance: Receive your LIC policy document, providing you with peace of mind and financial security.

How to Get Started?

Getting started with LIC is simple and straightforward. Follow these easy steps to secure your future:

- Consultation: Schedule a free consultation with our expert advisors to discuss your financial goals and insurance needs.

- Plan Selection: Choose the LIC plan that best suits your requirements from our wide range of options.

- Documentation: Complete the necessary paperwork with our guidance, ensuring all details are accurate and up-to-date.

- Approval and Payment: Submit your application for approval. Once approved, make the initial premium payment to activate your policy.

- Policy Issuance: Receive your LIC policy document, providing you with peace of mind and financial security.